Generating a 5% yield from fixed income has changed dramatically over time | BMO Global Asset Management

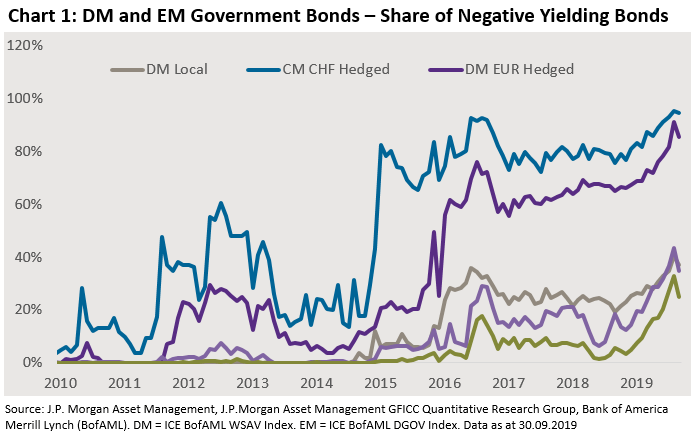

Emerging markets and the negative yield conundrum for fixed income investors | J.P. Morgan Asset Management

Ratio between the fixed yield that carries a 1% risk of collapse (Y... | Download Scientific Diagram

4: The phase portraits for the model with the fixed yield. Y (1) 0 < Y... | Download Scientific Diagram

.1566992778491.png?)

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)